Financial Management:

- Efficiently manage finances, including accounting, invoicing, and budgeting.

- Gain insights into revenue, expenses, and profitability.

Inventory Management:

- Track stock levels, monitor expiration dates, and reduce wastage.

- Optimize inventory for smoother distribution processes.

Sales and Distribution:

- Streamline sales orders, shipments, and delivery tracking.

- Enhance customer satisfaction with timely deliveries.

Purchase Management:

- Automate procurement processes.

- Monitor supplier performance and negotiate better deals.

Customer Relationship Management (CRM):

- Maintain customer profiles, interactions, and preferences.

- Strengthen customer relationships and loyalty.

Human Resource Management (HRM):

- Manage employee data, payroll, and attendance.

- Ensure a productive workforce.

Production Planning:

- Optimize production schedules and resource allocation.

- Minimize downtime and maximize output.

Quality Management:

- Implement quality control measures.

- Ensure consistent product quality.

Project Management:

- Track distribution-related projects.

- Collaborate effectively across teams.

Supply Chain Management:

- Monitor the entire supply chain, from sourcing to delivery.

- Identify bottlenecks and optimize processes.

Asset Management:

- Keep track of distribution assets (vehicles, warehouses, etc.).

- Schedule maintenance and replacements.

Warehouse Management:

- Efficiently organize and manage warehouse operations.

- Improve order fulfillment speed.

Order Management:

- Handle orders, returns, and exchanges seamlessly.

- Minimize errors and delays.

Vendor Management:

- Evaluate vendor performance and negotiate terms.

- Maintain strong supplier relationships.

Business Intelligence, Reporting, and Analytics:

- Access real-time data for informed decision-making.

- Generate reports and analyze distribution trends.

Document Management:

- Store and organize essential documents securely.

- Facilitate compliance and audits.

Mobile Access:

- Stay connected and manage distribution processes on the go.

Integration Capabilities:

- Integrate with other systems (e.g., accounting software, CRM).

- Ensure seamless data flow.

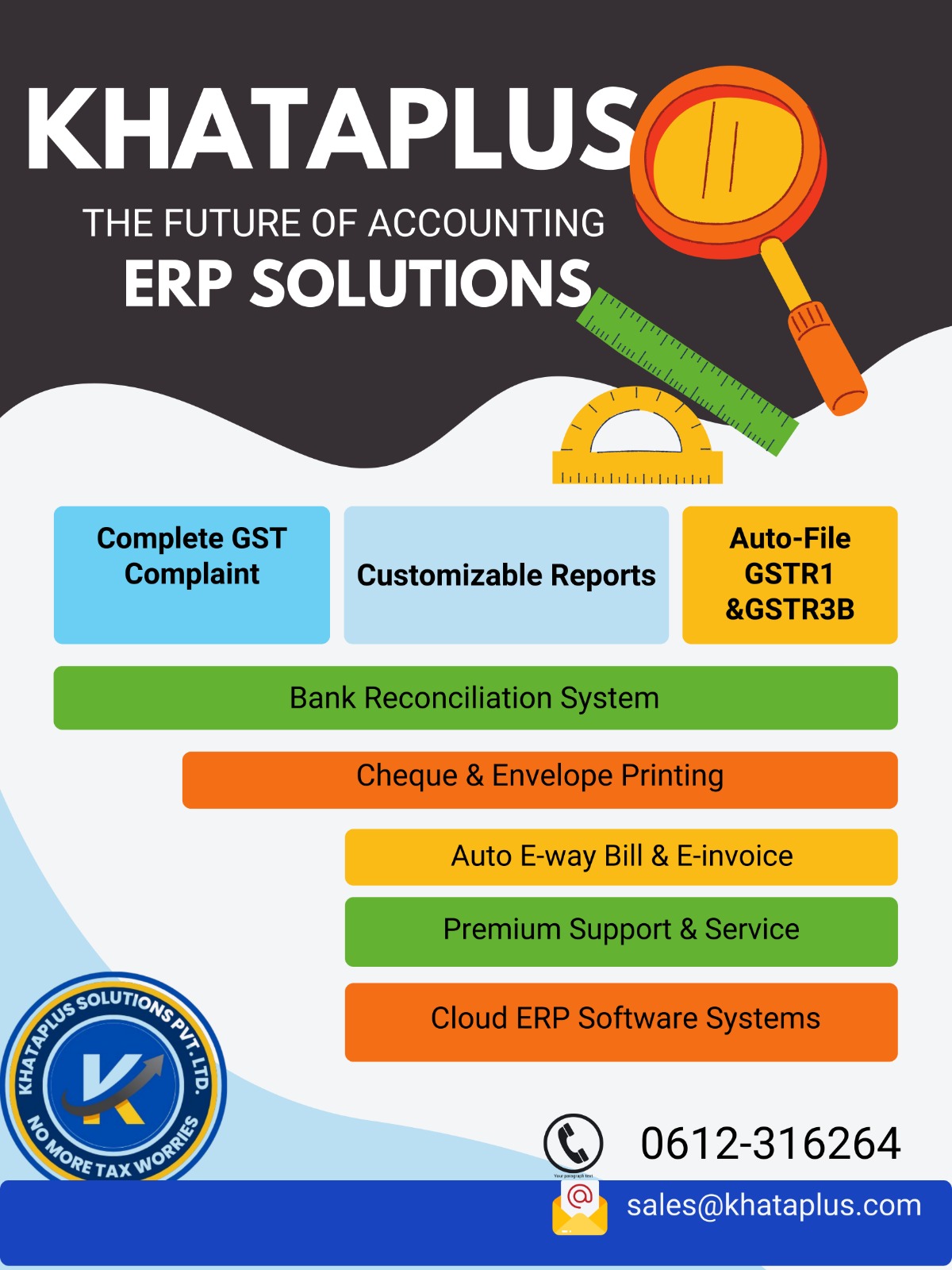

E-Invoicing Under GST:

- What? E-invoicing is a system where B2B invoices are authenticated electronically by GSTN.

- Purpose? Streamlines invoicing, improves accuracy, and facilitates compliance.

- How? Businesses generate invoices using approved e-invoicing software.

- Benefits? Enhanced efficiency, better financial record-keeping, and faster transaction processing.

E-Way Bill System:

- What? E-way bills are generated electronically for goods movement exceeding ₹50,000.

- Purpose? Ensures compliance during transportation.

- Features? Real-time tracking, seamless data flow, and verification by tax authorities.

- Khataplus Solutions’ Role? Integrates seamlessly with E-way bills, enhancing efficiency and

- compliance.

GSTR-1 (Sales Report):

- Filed by all registered taxable suppliers.

- Details outward supplies (sales) of taxable goods and services.

- Filed monthly or quarterly based on turnover.

- Mandatory for most registered taxpayers except composition dealers, input service distributors, non-resident taxable persons, and TCS/TDS collectors1.

GSTR-3B:

- Summary return filed monthly by regular taxpayers.

- Includes:

- Outward supplies details.

- Input tax credit (ITC) claimed.

- Tax payable and paid.

- Even if no outward supplies, GSTR-3B must be filed.

- Due by the 20th of each month for all registered taxpayers

Wholesale

26,500₹Wholesale

- o Track and manage your textile sales, purchases, inventory, and GST in one place

- o Generate accurate and compliant GST reports and file your returns online with ease

- o Access your data anytime, anywhere, from any device

- o Customize your software according to your business needs and preferences

- 3 user desktop based

- complete erp soluations

- 1 Year Amc Free Support After 1 Year 2500RS@per user For All product Support